Supporters Like You

We are thankful for those who have made an estate gift to Ohio Wesleyan University. Here are their stories.

Free Estate Planning Tool

Join fellow Ohio Wesleyan University supporters on Giving Docs, a safe, secure, and free-for-life suite of estate plan essentials.

Get Started

Nault Knows Best

Dick Nault has devoted four decades of his life to OWU. He also created an endowment that will help OWU students for years to come.

Read More

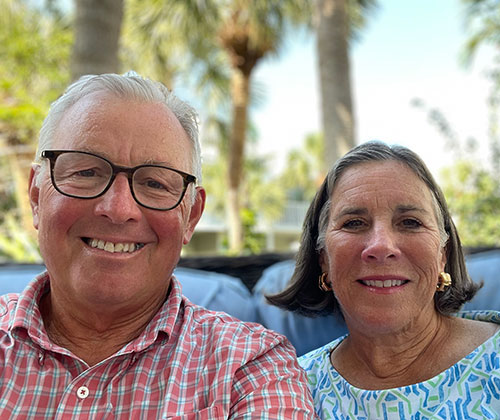

Paying it Forward: Jody ʼ79 and Kevin Garvey

Calling it “the easiest way to make a planned gift,” Jody (Stambaugh) Garvey ʼ79 and her husband, Kevin, named OWU as a beneficiary of their IRA. Here’s what Ohio Wesleyan meant to her and to her family, including two sons who also graduated from OWU.

Read More

A Trailblazer On and Off the Court: Laura Pierce Bump ‘58

When the late Laura Pierce Bump ’58 was celebrated as an OWU Alumni Award winner in 2013 it was said, “When we think of Laura, of course we think of sports.” A 1958 OWU graduate with a degree in Physical Education, Laura was an active participant in student life, including as a member of the YWCA, Red Cross, Panhellenic Council, Alpha Xi Delta and as student body vice president her senior year.

Read More

“Friending Up:” Ken Sternad ʼ77

Ken Sternard ‘77 knows a thing or two about the OWU legacy. Throughout his upbringing, the core values of Ohio Wesleyan were instilled in him by his father, George Sternad ‘48. George was an ardent supporter of Ohio Wesleyan, who “bled purple for Fiji and red and black for OWU.”

Read More

Meet Elizabeth Dale ’04

Like many other prospective students, choosing a university was a difficult decision for Elizabeth Dale ’04, Ph.D. And like many other students, Elizabeth came to OWU in part because of the generosity of alumni and donors through endowments and scholarships.

Read More

Going the Extra (3/4) Mile

“The church and Ohio Wesleyan were the two pillars my grandfather always counted on,” says grandson of Sterling Pfeiffer ’38. Read how Sterling and his wife, Meredith, built a legacy that will positively impact OWU students and their community for generations to come.

Read More

OWU Strong: From Loss to Legacy

Kathrine Grissom '92 is honoring her late mother's selflessness with an estate gift to OWU. The Mary Ellen Grissom Endowed Fund will provide comprehensive support for first-generation students at OWU.

Read More

Making Affordable Education a Reality

A retired head and neck surgeon, Dr. Diane Y. Petersen ’66 attended OWU on scholarship. Using both a planned gift and a cash gift to finance an endowed scholarship, Diane is able to support students who need the help now.

Read More

Service Scholars

Grace Ison '23 and Carissa Silet '23 created a small living community for students who share a commitment to community service. They can continue their learning and leadership thanks to scholarship support.

Read More

Inspiring Students With Faculty Innovation

The Shanklin Family knows well that great things happen when great minds are given the resources to learn and create. Dr. Robert E. Shanklin served as department chair of Geology for 16 years and was instrumental in establishing the Geography major. Dr. Shanklin touched the lives of thousands of students over his 45 years at Ohio Wesleyan, many of whom still remember him fondly decades later.

Read More

Taking the Back Roads to OWU

It was by chance that Kathy Mandusic Finley '77 stumbled upon Ohio Wesleyan. Her mother was determined that Kathy have the college education that she wasn't able to, so the two embarked on college visits together. On the way back from a lackluster visit to another college, Kathy and her mother decided to take the back roads home and came upon OWU. It was late on a Friday afternoon, but they stopped in the admission office, where a staff member stayed to take them all over campus, impressing them with a personal touch.

Read More

Investing in Ohio Wesleyan, Today and Tomorrow

Like many Ohio Wesleyan alumni, John Bassett '63 and Kay Hobart Bassett '63 share happy memories of their years at Ohio Wesleyan and of their many experiences after OWU, including their wedding in 1964. They recall the vibrancy of OWU's liberal arts campus, strong friendships, and especially the memorable professors whose voices linger long after they've gone.

Read More

Returning What's Been Given

In high school, Daly Walker '62 originally came to Ohio Wesleyan's campus with the intent of visiting his sister, who was already a student there. Little did he realize, he was visiting the right college for him, too.

Read More

Lifelong Legacy

Wendy Wood '76 has had a lifelong love for Ohio Wesleyan. To honor her time at OWU and make a difference for future students, Wendy made us a part of her legacy.

Read More

(K)Nocking at Your Door

Denis Nock '58 has had a plethora of successful experiences and challenges during his six-plus decades at such prestigious international companies as Bristol-Meyers, Hayden-Miller & Company investment bankers, and for the past 19 years, Colorado Financial Management (CFM) in Boulder.

Read More